Bigbloc Construction Ltd. Share Price Target

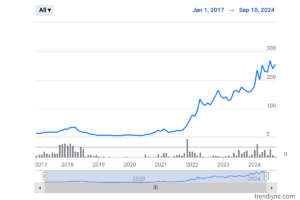

Bigbloc Construction Ltd. Share Price Today

Bigbloc Construction Ltd. is an attractive long term investment option due to its strong financial performance and consistent returns, ranking high in the Nifty500 index. The company offers a higher than average dividend yield and has shown improvments in net cash flow, annual flow, annual profits, and book value per share. The absence of promoter pledge and rising institutional interest further bolster its appeal. Despite the concerns, the growing demand for infrastructure and opportunities for market expansion present promising prospects. Overall, Big block Construction Ltd. offers a solid investment opportunity with a strong track record and positive financial indicators.

Here are the projected share price target for Bigbloc Construction Ltd. for 2025, 2026, 2027, 2028, 2029, 2030, 2040, upto 2050 based on various analyses.

| Year | Target 1 | Target 2 |

|---|---|---|

| 2025 | ₹390 | ₹425 |

| 2026 | ₹475 | ₹543 |

| 2027 | ₹597 | ₹656 |

| 2028 | ₹691 | ₹785 |

| 2029 | ₹803 | ₹897 |

| 2030 | ₹976 | ₹1156 |

| 2040 | ₹1768 | ₹2134 |

| 2050 | ₹3421 | ₹5436 |

Bigbloc Construction Ltd. Share Price Target 2025 :

Analysts predict potential Targets of ₹390, ₹425 by the end of 2024. The stop loss levels are set at ₹351, ₹3382.5.

Bigbloc Construction Ltd. Share Price Target 2026 :

Projections for 2026 suggests a minimum Target of ₹475 and a maximum of ₹543.

Bigbloc Construction Ltd. Share Price Target 2027 :

The price target range from ₹597 to ₹656 depending on market conditions.

Bigbloc Construction Ltd. Share Price Target 2028 :

At the start of 2028, the price is projected to be around ₹691 and by the end of the 2028, the price target is expected to reach approximately ₹785.

Bigbloc Construction Ltd. Share Price Target 2029 :

The share price is expected to start the year around ₹803 and by the end of the year, the share price might reach approximately ₹897.

Bigbloc Construction Ltd. Share Price Target 2030 :

Long term projections for 2030 range from ₹976 to ₹1,156 with an average target of ₹1,84.5.

Bigbloc Construction Ltd. Share Price Target 2040 :

The stock could be potentially be in the range of ₹1,768 to ₹2,134 depending on the market conditions, inflation, and the company’s performance.

Bigbloc Construction Ltd. Share Price Target 2050 :

With continued growth, the stock could theoretically reach ₹3,421 to ₹5,436 or more, but this is highly speculative and assumes that the company continues to perform well over long term.

For more detailed projections and updates, it is advisable to keep track of market reports and financial news.

About The Company

Bigbloc Construction Ltd. was founded June 17, 2015 and is headquartered in Surat, India. The company engaged in the manufacturing of building blocks and aerated autoclave concrete bricks. Visit nxtbloc.in for more info.

Fundamentals Of The Company

| Market Cap | ₹1,782 Cr |

| PE Ratio(TTM) | 60.94 |

| P/B Ratio | 17.13 |

| Industry P/E | 38.19 |

| Debt to Equity | 1.37 |

| ROCE | 24.0% |

| ROE | 29.70% |

| Div Yield | 0.16% |

| Book Value | ₹14.70 |

| Face Value | 2 |

| EPS(TTM) | 4.13 |

- Market Cap : The market capitalization of Bigbloc Construction Ltd. is ₹1,782 crore. This figure represents the total market value of the company’s outstanding shares and indicates its size and significance in the stock market.

- P/E Ratio : The Price to Earning (P/E) Ratio for Bigbloc Construction Ltd. based on trailing twelve months(TTM) data is 60.94. This ratio indicates how much investors are willing to pay per rupee of earnings, reflecting market expectations of the company’s future growth prospects.

- P/B Ratio : The Price to Book Ratio for Bigbloc Construction Ltd. is 17.13. This ratio compares the company’s market capitalization to its book value, providing insight into how much investors are willing to pay for each rupee of net assets.

- Industry P/E : The Industry P/E Ratio is 38.19. This figure represents the average P/E Ratio for companies within the same industry, providing a benchmark for comparing Bigbloc Construction Ltd.’s valuation to its peers.

- Debt to Equity : The Debt to Equity for Bigbloc Construction Ltd. is 1.37. This indicates that the company has relatively low levels of debt compared to its equity, suggesting a conservative approach to leveraging.

- ROE : The Return on Equity for Bigbloc Construction Ltd. is 29.70%. This metric measures the company,s profitability relative to shareholder’s equity, indicating how effectively it is using shareholder’s funds to generate profit.

- EPS : The Earnings Per Share for Bigbloc Construction Ltd. is 4.13. This figure represents the portion of a company’s profit allocated to each outstanding share of common stock, reflecting its profitability on a per-share basis.

- Div Yield : The Dividend Yield for Bigbloc Construction Ltd. is 0.16%. This ratio indicates the percentage of the company’s share price that is paid out as dividends to shareholders annually.

- Book Value : The Book Value per Share for Bigbloc Construction Ltd. is ₹14.70. This figure represents the value of the company’s net assets available to common shareholders, dividend by the number of outstanding shares.

- Face Value : The Face Value per Share for Bigbloc Construction Ltd. is 2. This is the nominal value of each share as stated on the stock certificate and does not reflect the market value of the share.

Financial Performance

Annual Revenue : Increased by 23.11% to ₹247.37 Cr, it’s last fiscal year sector’s average revenue growth was 11.46%

Quarterly Revenue : Fell 6.02% YoY to ₹52.26 Cr. compared to the sector’s average 0f 4.51%

Annual Net Profit : Soared by 1.92% to ₹30.9 Cr. far exceeding the sector’s average of 145.68%

Quarterly Net Profit : Fell 27.03% YoY to ₹4.39 Cr. well above the sector’s average of -11.08%

Stock Price : Increased by 52.14% underperforming its sector’s by 6.53%

Return on Equity : For the last financial year was 29.69%. in the normal range of 10% to 20%

Financial Ratio (Last 5 Years)

| Year | Operating Profit Margin | Net Profit Margin | Earning Per Share |

|---|---|---|---|

| 2020 | 9.01% | 2.07% | 1.74 |

| 2021 | 11.98% | 2.40% | 0.35 |

| 2022 | 15.81% | 9.18% | 2.27 |

| 2023 | 25.41% | 15.06% | 4.28 |

| 2024 | 24.80% | 12.62% | 4.36 |

Shareholding Pattern

- Promoter Share Holding : Stayed the same at 72.4%

- Retail Holding : 27.3%

- Other Domestic Institutions : 0.3%

PROS and CONS of Bigbloc Construction Ltd.

Gainers/Loosers

Penny Stocks To Buy Now

All About Indian Stock Market – BSE, NSE, SEBI, SENSEX, NIFTY 50

Disclaimer

The author and this blog do not assume any responsibility for any investment decisions made based on the information provided. Always exercise and due diligence when investing.